Property Tax

2026 Levy Rate

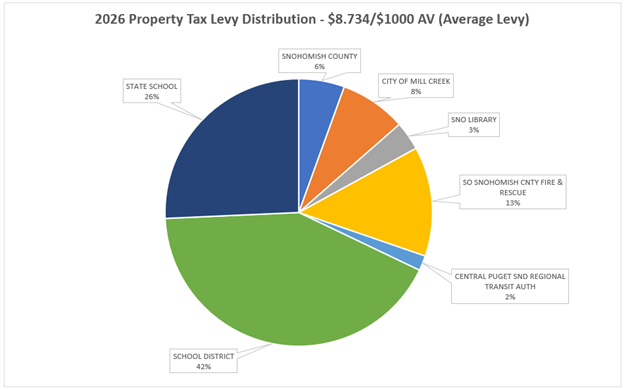

The 2026 typical property tax rate is $8.734 per $1,000 assessed value (AV). Of this rate, the City of Mill Creek’s portion is $0.70 per $1,000 AV or 8.0%. On November 4, 2025, City Council adopted Ordinance No. 2025-937 authorizing a 5.0% increase of property tax levy rate from $0.689 to $0.700 per $1,000 AV.

2026 Assessed Value

Countywide, the 2026 assessed value of homes increased by an average of 6.7%. In the City of Mill Creek, the assessed value of homes grew by an average of 7.9%. For example, a home with an assessed value of $884,700 in 2025 increased to $954,300 in 2026.

Learn More

The Snohomish County Assessor's Office is responsible for annually updating the assessed values for all locally assessed real and personal property in Snohomish County and calculating the levy rates for all taxing districts for property tax purposes.

For more information on how property tax levies are calculated, visit snohomishcountywa.gov/333/Levy

Tax Relief & Property Tax Exemptions

There are several tax relief programs that the Assessor's office administers. Information can be found on the back side of your property tax statements or by visiting Snohomish County Assessors Website to learn more. The Snohomish County Assessor's Office offers various programs to help reduce property taxes. These programs apply to groups such as Senior Citizens, people with disabilities, limited income, non-profits, historical property, and more.