Property Tax

2025 Levy Rate

The 2025 typical property tax rate is $8.816 per $1,000 assessed value (AV). Of this rate, the City of Mill Creek’s portion is $0.689 per $1,000 AV or 8.0%. On November 12, 2024 City Council adopted Ordinance No. 2024-924 authorizing a 1.0% increase of property tax levy rate from $0.682 to $0.689 per $1,000 AV.

2025 Assessed Value

Countywide, the 2025 assessed value of homes increased by an average of 4.4%. In the City of Mill Creek, the assessed value of homes grew by an average of 2.4%. For example, a home with an assessed value of $863,700 in 2024 increased to $884,700 in 2025.

Learn More

The Snohomish County Assessor's Office is responsible for annually updating the assessed values for all locally assessed real and personal property in Snohomish County and calculating the levy rates for all taxing districts for property tax purposes.

For more information on how property tax levies are calculated, visit snohomishcountywa.gov/333/Levy

Tax Relief & Property Tax Exemptions

There are several tax relief programs that the Assessor's office administers. Information can be found on the back side of your property tax statements or by visiting Snohomish County Assessors Website to learn more. The Snohomish County Assessor's Office offers various programs to help reduce property taxes. These programs apply to groups such as Senior Citizens, people with disabilities, limited income, non-profits, historical property, and more.

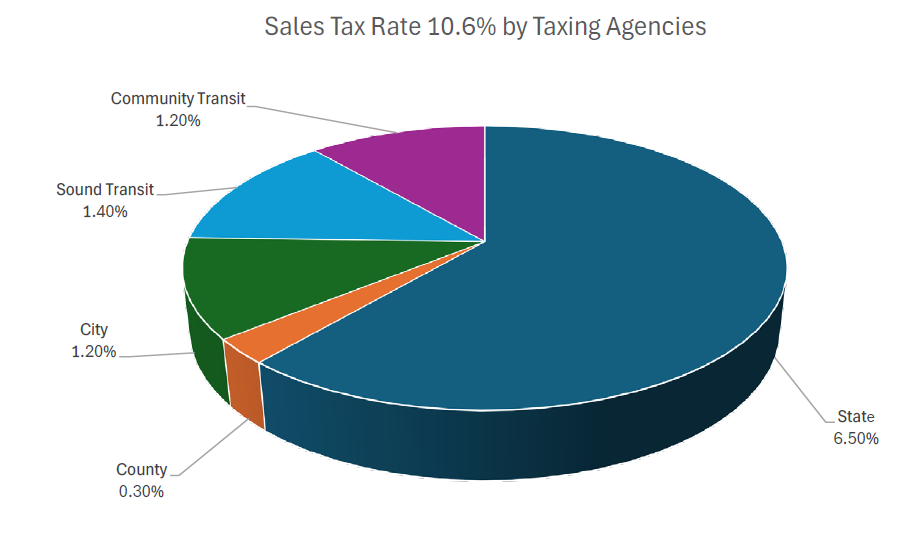

Sales Tax Breakdown

Washington State - 6.5%

Have questions about Washington State's sales tax? Visit the Department of Revenue website.

City of Mill Creek - First Half - 0.50%

Per RCW 82.14.030(1).

City of Mill Creek - Second Half - 0.50%

Per RCW 82.14.030(2).

City of Mill Creek - Public Safety - 0.10%

Resolution No. 2012-491 dated 7/24/2012 Proposition No. 1 To authorize 0.10% sales and use tax for police and fire protection purposes. (11/6/2012 General Election approved by 67.20% of voters)

City of Mill Creek - Affordable Housing - 0.10%

Resolution No. 2019-583 dated 10/8/2019 City Council declared its intention to adopt legislation to authorize the maximum capacity of the sales and use tax authorized by SHB 1406 within 1 year of the effective date of SHB 1406 or by 7/28/2020 (RCW 84.52.105) up to 0.1% if county has not done so. Funds the operations & maintenance costs of new units of affordable or supportive housing. (RCW 82.14.540 Expires 20 yrs after tax is first imposed)

Snohomish County - Criminal Justice - 0.10%

Snohomish County Ordinance 90-143 dated 9/26/1990 Imposed 0.10% sales and use tax per proceeds of which shall be exclusively for criminal justice purposes effective 7/1/1982.

Snohomish County - Emergency Comm. Systems & Facilities - 0.10%

Snohomish County Ordinance No. 18-037 Proposition No.1 a.k.a. 911 Sales & Use Tax - imposes countywide sales and use tax of 0.10% for emergency communication systems and facilities. (11/6/2018 General Election approved 54.19% by voters)

Snohomish County - Mental Health & Drugs - 0.10%

RCW 82.14.460 authorizes imposition of 0.10% sales and use tax strictly use for chemical dependency or MH treatment or therapeutic courts.

Community Transit - Public Transit - 1.20%

Community Transit (SnoCo PTBA) - Established in 1976 per RCW82.14.045see RCW 36.57A includes an addition 0.3% sales tax for a county of 700K or more that includes a city of 75K or more funding operation, maintenance, or capital needs of public transportation systems.

Sound Transit - Mass Transit - 0.50%

Sound Transit Resolution No. R2016-17 Light-Rail, Commuter-Rail & Bus Service Expansion imposes 0.50% sales and use tax plus property tax levy of $0.25 or less per $1000 plus 0.8% motor vehicle excise tax to expand mass transit in King, Pierce & Snohomish Counties. Effective 4/1/2017. (11/8/2016 General Election approved by 51% of voters).

Sound Transit - Mass Transit - 0.50%

Sound Transit Resolution No. R2008-11 Expansion of mass transit imposes an additional 5/10th of 1% sales and use tax to pay for planning, devt, permanent operation & maintenance of high-capacity transportation system. Effective 1/1/2009. (11/4/2008 General Election approved by 54.21% of voters.)

Sound Transit - Mass Transit - 0.40%

Regional Transit Authority Resolution No. 96-73Imposes 4/10 of 1% sales and use tax. (11/5/1996 General Election approved by 58% of voters)