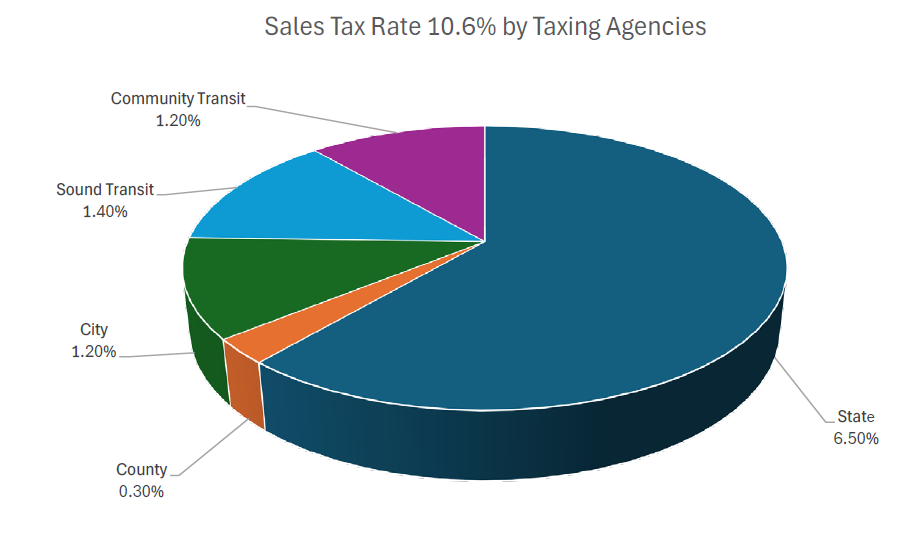

Sales Tax Breakdown

Washington State - 6.5%

Have questions about Washington State's sales tax? Visit the Department of Revenue website.

City of Mill Creek - First Half - 0.50%

Per RCW 82.14.030(1).

City of Mill Creek - Second Half - 0.50%

Per RCW 82.14.030(2).

City of Mill Creek - Public Safety - 0.10%

Resolution No. 2012-491 dated 7/24/2012 Proposition No. 1 To authorize 0.10% sales and use tax for police and fire protection purposes. (11/6/2012 General Election approved by 67.20% of voters)

City of Mill Creek - Affordable Housing - 0.10%

Resolution No. 2019-583 dated 10/8/2019 City Council declared its intention to adopt legislation to authorize the maximum capacity of the sales and use tax authorized by SHB 1406 within 1 year of the effective date of SHB 1406 or by 7/28/2020 (RCW 84.52.105) up to 0.1% if county has not done so. Funds the operations & maintenance costs of new units of affordable or supportive housing. (RCW 82.14.540 Expires 20 yrs after tax is first imposed)

Snohomish County - Criminal Justice - 0.10%

Snohomish County Ordinance 90-143 dated 9/26/1990 Imposed 0.10% sales and use tax per proceeds of which shall be exclusively for criminal justice purposes effective 7/1/1982.

Snohomish County - Emergency Comm. Systems & Facilities - 0.10%

Snohomish County Ordinance No. 18-037 Proposition No.1 a.k.a. 911 Sales & Use Tax - imposes countywide sales and use tax of 0.10% for emergency communication systems and facilities. (11/6/2018 General Election approved 54.19% by voters)

Snohomish County - Mental Health & Drugs - 0.10%

RCW 82.14.460 authorizes imposition of 0.10% sales and use tax strictly use for chemical dependency or MH treatment or therapeutic courts.

Community Transit - Public Transit - 1.20%

Community Transit (SnoCo PTBA) - Established in 1976 per RCW82.14.045see RCW 36.57A includes an addition 0.3% sales tax for a county of 700K or more that includes a city of 75K or more funding operation, maintenance, or capital needs of public transportation systems.

Sound Transit - Mass Transit - 0.50%

Sound Transit Resolution No. R2016-17 Light-Rail, Commuter-Rail & Bus Service Expansion imposes 0.50% sales and use tax plus property tax levy of $0.25 or less per $1000 plus 0.8% motor vehicle excise tax to expand mass transit in King, Pierce & Snohomish Counties. Effective 4/1/2017. (11/8/2016 General Election approved by 51% of voters).

Sound Transit - Mass Transit - 0.50%

Sound Transit Resolution No. R2008-11 Expansion of mass transit imposes an additional 5/10th of 1% sales and use tax to pay for planning, devt, permanent operation & maintenance of high-capacity transportation system. Effective 1/1/2009. (11/4/2008 General Election approved by 54.21% of voters.)

Sound Transit - Mass Transit - 0.40%

Regional Transit Authority Resolution No. 96-73Imposes 4/10 of 1% sales and use tax. (11/5/1996 General Election approved by 58% of voters)